Without any hiccups or last-minute scrambles, you’ll be able to enter tax season confidently. At first glance, bookkeeping and accounting may seem interchangeable. While it may be easy to confuse the two, they are not the same thing. Accounting is the umbrella term for all processes related to recording a business’s financial transactions, whereas bookkeeping is an integral part of the accounting process.

When first starting out, market yourself as a professional who is well-versed in managing accounts, reconciling transactions, providing financial overviews and balancing budgets. Ask for testimonials from people who have utilized your services in the past and spread the word about your offerings through a website or social media. So, instead of trying to figure out, “how does bookkeeping work”, you can hire a bookkeeper to handle the entire process. Doing so can make it easier to focus on the aspects of your business better-suited to your skillset, and in the end, significantly reduce your stress. Because let’s be honest, no matter how much help you have, being a small business owner is a demanding gig. When you search for “what do bookkeepers do”, you’ve likely come across many articles that mention both bookkeepers and accountants—that can get kind of confusing.

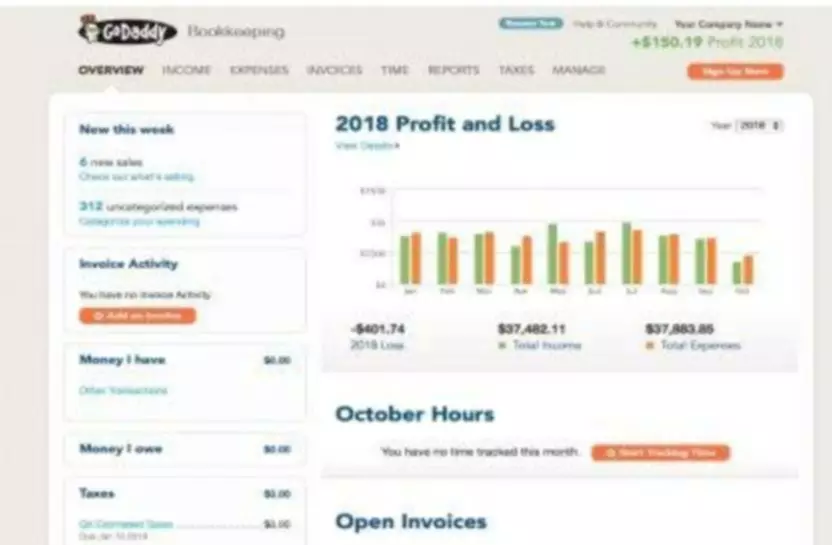

Why QuickBooks

The Certified Bookkeeper (CB) program from the AIPB requires you to be a working bookkeeper or have at least one year of accounting education. The program includes self-teaching workbooks that prepare you to pass the CB exam. Someformal certifications include the National Association of Certified Public Bookkeepers (NACPB) and the American Institute of Professional Bookkeepers (AIPB). Many of the processes, policies, and procedures include detail-oriented tasks to ensure financial accuracy. Learn about bookkeeping, typical responsibilities, how to become a bookkeeper, and remote bookkeeping opportunities with Intuit’s QuickBooks Live in the U.S. Keeping up with the records in your small business might be a task you are willing and able to tackle yourself.

Century Council President Questions Why Accountant Has Missed … – NorthEscambia.com

Century Council President Questions Why Accountant Has Missed ….

Posted: Wed, 02 Aug 2023 05:16:30 GMT [source]

She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Bookkeeper Salary Range

Keep reading to learn more about what bookkeepers do and how they can help you make your business better. Today, bookkeepers often work off-site or as freelancers which can benefit your business when it comes to cost. If you think about it, it’s usually much more expensive to hire an individual employee to have on-site. While you might be able to handle minimal incoming and outgoing transactions during the start-up phase, it will become increasingly complex and time-consuming—making a bookkeeper essential. When comparing accountants and bookkeepers, know that an accountant may also be a bookkeeper.

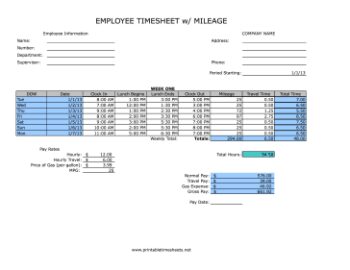

A bookkeeper is responsible for maintaining and recording financial transactions for a business or organization. Their primary role is to accurately track and categorize financial data, including income, expenses, invoices, and payments. Bookkeepers play an important role in ensuring the financial records are organized, up-to-date, and compliant with applicable regulations. The responsibilities of a bookkeeper include a fair bit of data entry and receipt wrangling.

Benefits of bookkeepers and bookkeeping

An accounts payable analyst is primarily responsible for managing and processing invoices and payments, ensuring accuracy and timeliness. Bookkeepers are employees who are in charge of the company’s general ledger. They are well-versed in basic accounting principles, and they apply these in their work. Bookkeepers manage the entry of items in the general ledger, assign items into their proper categories, and ensure that the entries are balanced. They also act as auditors by checking the accuracy and veracity of the receipts or vouchers in their possession before entering them into the system.

If you don’t feel comfortable with a freelancer, there are many firms that offer bookkeeping services as well. While a bookkeeper does not necessarily do your business tax returns for you, they can be instrumental in the process. Your bookkeeper or accountant will work with your tax preparer to ensure that all the information about your business’ finances is accurate. Double-entry bookkeeping records all transactions twice, usually a debit and a credit entry. Typically, double-entry bookkeeping uses accrual accounting for liabilities, equities, assets, expenses and revenue.

- If you’re like most modern business owners, odds are you didn’t become one so that you could practice professional-level bookkeeping.

- That’s especially helpful if you’re responsible for quarterly taxes.

- If you find someone who is a good fit for your business needs, it doesn’t matter if they are in California while you work from New York.

- Freelance jobs can range from quick temporary projects to long-term employment.

- You can either get some bookkeeping software and learn how to do it yourself, or you can outsource your bookkeeping to a part-time, virtual bookkeeping service like Bench.

- We recommend taking the time to find a bookkeeper you can trust a great deal.

They’re both condiments, and they work well together, but they’re not the same. The Venetians of the 15th century are considered the fathers of accounting. In 1494, mathematician Luca Pacioli published the world’s first bookkeeping treatise detailing the use of bookkeeping by Venetian merchants. Jesus Morales is an Enrolled Agent and has 7 years of bookkeeping and tax experience.

key benefits of bookkeeping

You can sometimes choose between full-time and part-time positions, and you may go to work in an office or work from home. It’s a skill used in both large companies and small businesses, and bookkeepers are needed in just about every business and industry. Learn more about what bookkeepers do and how to get started in this career. Before we dive deeper into the question at hand—What does a bookkeeper do?

The material, labor, and overhead costs and revenue from the landscaping job posted when Riverside performed the work. Riverside’s $400 profit posted when they billed the Joneses on March 20. When you can match revenue with expenses, you’ll know the profitability of each product or service.

What is business accounting? 21 tips for business owners

Bookkeeping is the ongoing recording and organization of the daily financial transactions of a business and is part of a business’s overall accounting processes. One way to think about it is that bookkeepers lay the groundwork for accountants to analyze and prepare financial statements. A Bookkeeper is responsible for recording and maintaining a business’ financial transactions, such as purchases, expenses, sales revenue, invoices, and payments. They will record financial data into general ledgers, which are used to produce the balance sheet and income statement. A bookkeeper’s role at a company varies by the size and nature of the business.

You can work with other bookkeepers and tax experts to share and expand your knowledge. What’s it like to work as a Front Office Expert or Back Office Expert for QuickBooks Live? Watch the videos to find out what a day in the life is like for our Intuit bookkeeping experts. Now that we’ve answered your primary questions, “what does a bookkeeper do” the impact of expenses on the balance sheet and “does your business need a bookkeeper”, let’s discuss how to find a good bookkeeper that you can rely on. Kelly is an SMB Editor specializing in starting and marketing new ventures. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content.

If there’s a discrepancy between the books and your bank, your bookkeeper will help you get to the bottom of it. Whether you’ve started a small business or are self-employed, bring your work to life with our helpful advice, tips and strategies. Regardless of the setting, bookkeepers must maintain a high level of accuracy and attention to detail. They must be able to work independently and as part of a team, and they must be able to communicate effectively with clients, vendors, and other stakeholders. Take our free career test to find out if bookkeeper is one of your top career matches. Access all Xero features for 30 days, then decide which plan best suits your business.

- Find out what bookkeepers do, and get an intro to double-entry bookkeeping.

- When making this decision, there are two things you should keep in mind.

- They ensure that business financial records are up-to-date and accurate, and this helps companies make financial decisions and focus on growing their business and focus on growing their business.

- In 1494, mathematician Luca Pacioli published the world’s first bookkeeping treatise detailing the use of bookkeeping by Venetian merchants.

In most cases, asset and expense accounts increase with each debit entry. In most cases, liability and revenue accounts increase with a credit entry. Finally, the total dollar amount of debits must always equal credits. Accounting and bookkeeping software requires each journal entry to post an equal dollar amount of debits and credits. Not only do the daily responsibilities of bookkeepers vary, but there are also different types of bookkeeping services you can seek out.