You issued a check to Mr. X (one of your creditors) for $500 on January 31, 2021 and entered it immediately in your accounting records. Mr. X did not present or deposit that check in his account before the end of January. Your bank statement for the month of January would not show the entry for that $500 because Mr. X did not present this check before the end of January. It would essentially create a difference of $500 between the balance in your accounting records and the balance in the bank statement. Bank reconciliation statements compare transactions from financial records with those on a bank statement. Where there are discrepancies, companies can identify and correct the source of errors.

Make Necessary Adjustments in the Balance as per the Cash Book

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Bank reconciliations should be performed at least at the end of each month, or more often in a business with a large number of transactions.

Electronic bank reconciliation

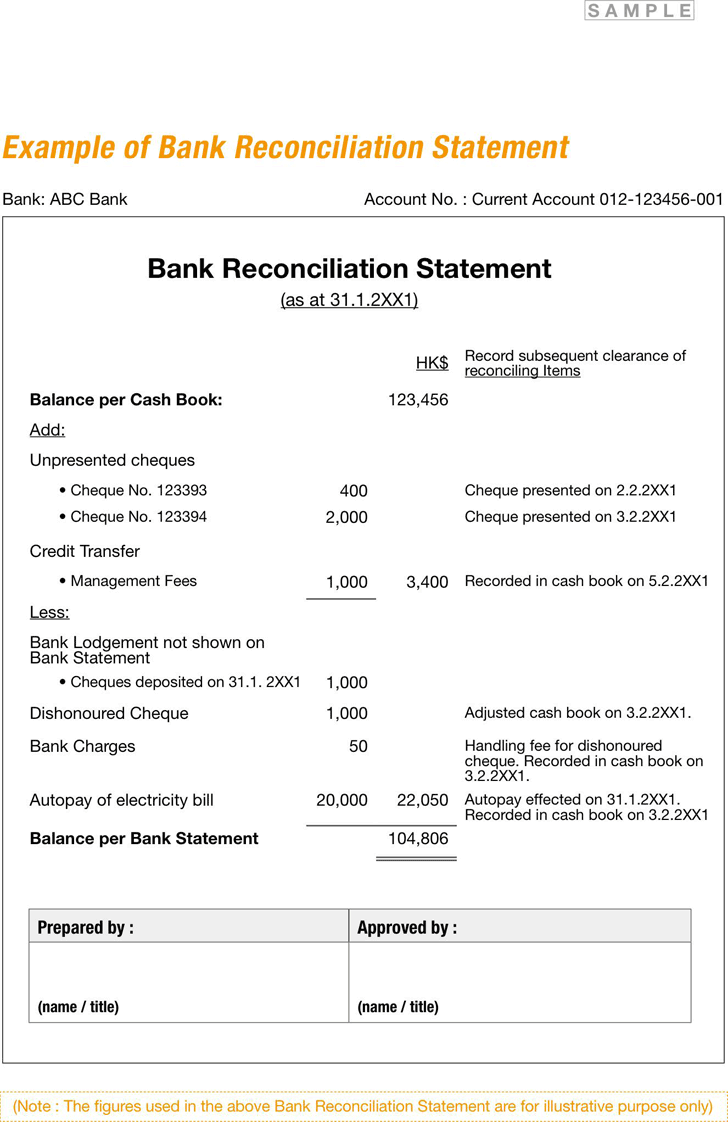

The purpose of preparing a bank reconciliation statement is to find and understand the reasons of this difference in account balance. Additionally, bank reconciliation statements brings into focus errors and irregularities while dealing with the cash. Once you determine the differences between the balance as per the cash book and the balance as per the passbook, you’ll need work out the balance as per the bank portion of the bank reconciliation statement.

- As a result of these direct payments made by the bank on your behalf, the balance as per the passbook would be less than the balance as per the cash book.

- All of this can be done by using online accounting software like QuickBooks, but if you are not using accounting software, you can use Excel to record these items.

- Check your ledger’s recorded deposits, withdrawals and cleared checks against those listed on the bank statement.

What is a bank reconciliation statement?

The key is to establish a routine that best suits your business’s unique needs and financial activity. The information on your bank statement is the bank’s record of all transactions impacting the company’s bank account during the past month. Compare the ending balance of your accounting records to your bank statement to see if both cash balances how should i record my business transactions match. We strongly recommend performing a bank reconciliation at least on a monthly basis to ensure the accuracy of your company’s cash records. A monthly reconciliation helps to catch and identify any unusual transactions that might be caused by fraud or accounting errors, especially if your business uses more than one bank account.

Go through both statements and highlight any transactions that appear on only one side. Note that transactions may take a few days to clear, so the transaction date in your financial records may not precisely match the date on your bank statement. Let’s take a look at a hypothetical company’s bank and financial statements to see how to conduct a bank reconciliation. As a matter of practice, banks send a list of entries to each account holder that have been made in their personal account, which is maintained by the bank.

Company’s Process for Preparing its Bank Reconciliation

Companies prepare bank reconciliation statements as a comprehensive accounting comparison tool. A company can ensure that all payments have been processed accurately by comparing their internal financial records against their bank account balance. Bank reconciliation statements are also important for alerting a company in case of fraud or error. To be effective, a bank reconciliation statement should include all transactions that impact a company’s financial accounts. Bank reconciliation is an important financial control process that helps ensure your financial records are accurate, and there are zero unexplained inconsistencies in your day-to-day transactions. Bank administrators process bank service fees, interest, and other bank transactions that you might not be aware of or not know the exact amounts of.

(f) The cash book does not contain a record of bank charges, $70, raised on 31 May. These checks are the ones that have been issued by your business, but the recipient has not presented them to the bank for the collection of payment. However, sometimes there are differences between the two balances and so you’ll need to identify the underlying reasons for such differences. All of this can be done by using online accounting software like QuickBooks, but if you are not using accounting software, you can use Excel to record these items. After adjusting all the above items what you’ll get is the adjusted balance of the cash book. However, there can be situations where your business has overdrafts at the bank, which is when a bank account goes into the negative as a result of excess withdrawals.

Instead of doing a bank reconciliation manually and risking oversight, you need expense management software to ensure efficiency and accuracy. Add to your accounting record any credit memorandum, that you have not already entered. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Checks that have been issued by a business to creditors and credited in a cash book–but the payments have not yet been processed by a bank and so do not appear on a bank statement. The goal of bank account reconciliation is to ensure your records align with the bank’s records. This is accomplished by scanning the two sets of records and looking for discrepancies. If you find any errors or omissions, determine what happened to cause the differences and work to fix them in your records.