Content

You will most likely report the income from your 1099s on Schedule C, Profit or Loss from Business. Since Uber reports this income information directly to the IRS, you don’t have to include the actual 1099 forms with your tax return. Schedule C can also be used to list your business-related expenses. City regulators across the US have also found drivers using fake names. One driver in Houston who cleared Uber’s background checks in 2015 reportedly had 24 aliases, five listed birthdates, 10 listed Social Security numbers and an active warrant for his arrest.

This takes care of the costs of owning and operating your automobile. You can reclaim 100% of the VAT paid on fuel used for business reasons. You must, however, be able to show that the fuel was utilized solely for work purposes and that no personal trips were conducted. Unless you own a cab company or a driving school, this is challenging.

Taxi, Uber and Zoomy Taxation

A parent or guardian can invite their teen to create an account through the Family Profile in the Uber app. The teen will receive a link to download the app, create their account. This device can protect you against abusive riders and incidents and provide proof in case you need to make a claim or file an incident report.

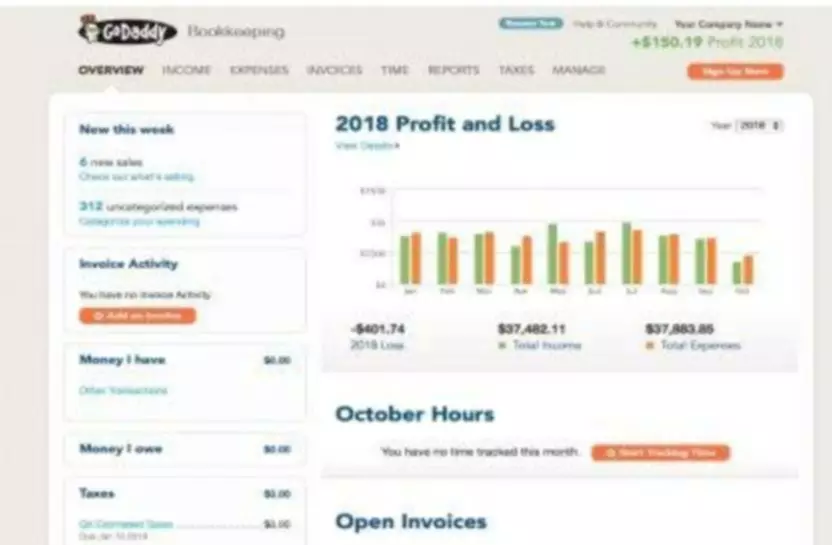

That way the company’s Saudi owners could raise investment capital from subsequent “investors” (AKA “suckers”) all the way up to the IPO, cash out, and walk away, whistling innocently. We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2023. On the other hand, if you’re planning on expanding your business, make sure the software you choose can grow with you. Don’t let yourself get bogged down with too much stuff you don’t need. The best software will have what you need without all the added frills that a larger company would need. Then, in December 2015, Uber unveiled its updated contract, which appeared to address the commission issue.

The Uber & Lyft Driver’s Guide to Taxes

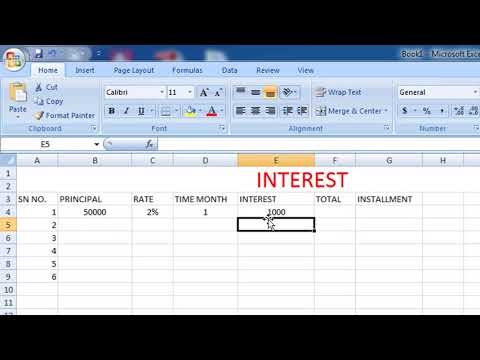

That’s just more for you to make sure you’re putting… the time you spend on the road is being profitable. Then when we go down to the instructions starting on Line 23, it’s a bit of how do you enter your info on the Uber and Lyft tabs. It’s a little basic set up you have to do, but once you set it up correctly, you just pop it in every day. Uber is launching teen accounts in a handful of cities, including Cincinnati, Columbus and Dayton. Ride-share company Uber unveiled several changes Wednesday, including an update that will allow teens under the age of 18 to travel by themselves for the first time. That’s a real question given Uber’s recent track record.

If you recently moved to a new state, you might be required to submit extra information to verify your driving history. Be sure to have your old state’s driver’s license and insurance on hand. That’s the bezzle at work — a dazzle op that keeps new money flowing in, convincing people that a pile of shit this big must have a pony beneath it. But as the years went by, the stories that Uber told us about its path to profitability got more and more fanciful. Like the pretense that self-driving cars would eliminate all their labor costs. They spent billions on a doomed effort, then had to bribe another company with a $400m “investment” to take its window-dressing away.

What Kind of Insurance Do I Need for Uber?

Instabooks Uber & Taxi logbook software and app is designed for Uber & Taxi drivers. Record and keep track of daily Uber & Taxi spendings in your expense logbook. Instabooks Uber & Taxi receipt scanner software and app is designed for Uber & Taxi drivers. Stop losing Uber receipts by simply scanning, storing, storing pictures of receipts online. As an Uber driver-partner, you’re an independent contractor, not an Uber employee. Follow these tips to report your income accurately and minimize your taxes.

The Uber tax summary of total online miles includes all the miles you drove waiting for a trip, en-route to a rider, and on a trip. • Since your Uber ridesharing is a business, you will typically use Schedule C, Profit or Loss from Business to deduct your business-related expenses and report your profits for the tax year. uber driver accounting “But when you have 45,000 drivers in the city of London, it’s important to design systems that assume that some of those drivers will try and take advantage.” Campbell, who runs the Rideshare Guy blog, said he’s heard of drivers purchasing fake identities on the dark web and applying for Uber with those documents.

Business 101

Support has been getting better over the years but still needs major improvement. Biggest issue is the competition for when we make it to a restaurant and they only allow drive thru and it has 20+ cars in line (that’s like an hour wait) and then we don’t get compensated or we have to wait the entire time. Same type of issue with closed restaurants and order and pay restaurant that refuse to take orders. More promotions in Montana for Uber eats and uberX would be great as a 1.3x boost for delivery at dinner isn’t that helpful. Some of our drivers have over 20,000 deliveries completed.

- Maximum Ridesharing Profits is The Rideshare Guy’s online video course.

- This page contains references to codes and links that earn The Rideshare Guy a commission when used.

- You can learn more about how Uber teen accounts work and get answers to common questions on the teen accounts information page.

- This category includes ARB annual retention fee payments.

- The proposed rule also won’t change how it classifies its drivers, the company said in a blog post .

- However, you must keep careful records of your off-trip mileage.

Potential candidates with certain types of criminal convictions will be barred from driving. That can include those awaiting trial for serious offenses. People with restrictions on their driving license or a history of recent driving violations also risk being excluded.

Accounting tricks and tech gimmickry don’t matter when the coffers are empty.

These forms will typically report a higher income than what you actually received. This is because it reports the total of what your customers paid before Uber or Lyft takes their fees. Instabooks online bookkeeping software and finance app is built for Taxi https://kelleysbookkeeping.com/ drivers. Instabooks online bookkeeping software and finance app is built for Grab drivers. Instabooks online bookkeeping software and finance app is built for Lyft drivers. Instabooks online bookkeeping software and finance app is built for Uber drivers.

Come back at a time when you got the hang of things a little bit more, after a month or two. By then, you’ll really want to start thinking about how much you’re earning and how much you’re making. You can use a copy of his spreadsheet by downloading it. Uber said it spent more than a year developing teen accounts and consulted with safety experts, like Safe Kids Worldwide, a global nonprofit organization dedicated to protecting children from preventable injuries. Parents and guardians can now invite their kids, ages 13-17, to create a specialized Uber account that will allow the teens to request their own rides with parental supervision and safety features built into the experience.

“We meet with all stakeholders to gather information while considering legislation, and continue to meet and work with this group on issues of common interest,” Mr. Burnell said. The problem with commissions has arisen amid driver discontent over a range of issues, including fare cuts instituted early last year. Now evidence has emerged suggesting that Uber and New York State regulators were aware of the improper deductions from drivers’ earnings as early as 2015. For Uber, the key judgment about driver classification and potential revenue impacts was important enough to flag in its 2021 and 2020 year-end 10-Ks. Being forced to classify drivers as employees, workers, or even quasi-employees, “may impact our current financial statement presentation including revenue, cost of revenue, incentives and promotions,” Uber said.

- Please see our affiliate policy here for more information.

- If you have regular business expenses, it looks like you can set it up to automatically sync that information as you pay it, for less work for you.

- This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

- The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

- Self-employment taxes are essentially the self-employed version of Social Security and Medicare taxes.

Hourly rates vary, depending on the city where you are driving and the demand at that given time. Gridwise claims that hourly earnings can range anywhere from $5 to $26, on average, with its report showing New York City drivers making the most and El Paso, Texas, drivers making the least. Uber drivers can claim tax relief on professional subscriptions or fees that must be paid to do a job, according to HM Revenue and Customs (HMRC). This category includes ARB annual retention fee payments.