To convert the contribution margin into the contribution margin ratio, we’ll divide the contribution margin by the sales revenue. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. Thus, the level of production along with the contribution margin are essential factors in developing your business. Now, it is essential to divide the cost of manufacturing your products between fixed and variable costs. Expressed another way, the contribution margin ratio is the percentage of revenues that is available to cover a company’s fixed costs, fixed expenses, and profit.

Additional Resources

Further, the contribution margin formula provides results that help you in Retail Accounting taking short-term decisions. Let’s say your business sold $2,000,000 in product during the first quarter of the year. In this article, the experts at Sling will help you understand contribution margin ratio better, show you how to calculate it, and reveal the best way to reduce this ratio to generate more profit. The Contribution Margin Ratio is not all-powerful and omnipotent; it has its kryptonite. It observes the world from a high vantage point, not accounting for the impacts of fixed costs or the complexities of cash flow. In contrast, a low ratio indicates potential troubles, and a company that is not generating enough from sales to effortlessly glide over its variable expenses.

Breakeven Analysis

This analysis can aid in setting prices, planning sales or discounts, and managing additional costs like delivery fees. For example, a company aspiring to offer free delivery should achieve a scale where such an offering doesn’t negatively impact profits. That is, fixed costs remain unaffected even if there is no production during a particular period. Fixed costs are used in the break even analysis to determine the price and the level of production. It is important for you to understand the concept of contribution margin. This is because the contribution margin ratio indicates the extent to which your business can cover its fixed costs.

Variable Expenses

Thus, it will help contribution margin you to evaluate your past performance and forecast your future profitability. Accordingly, you need to fill in the actual units of goods sold for a particular period in the past. However, you need to fill in the forecasted units of goods to be sold in a specific future period.

- However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio.

- Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income.

- It’s also a helpful metric to track how sales affect profits over time.

- The contribution margin ratio is just one of many important financial metrics used for making better informed business decisions.

- Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them.

- With a contribution margin of $200,000, the company is making enough money to cover its fixed costs of $160,000, with $40,000 left over in profit.

Fixed costs are production costs that remain the same as production efforts increase. Say, your business manufactures 100 units of umbrellas incurring a total variable cost of $500. Accordingly, the Contribution Margin Per Unit of Umbrella would be as follows. If you want to reduce your variable expenses — and thereby increase your contribution margin ratio — start by controlling labor costs. The Contribution Margin Ratio is integral to breakeven analysis because it helps determine the sales volume needed to cover all costs. Knowing this threshold gives businesses a target to aim for profitability.

Fixed cost

When preparing to calculate contribution margin ratio, you will need to add together all of your variable expenses into one number. Variable expenses are costs that change in conjunction with some other aspect of your business. Cost of materials purchased is a variable expense because it increases as sales increase or decreases as sales decrease. In the most recent period, it sold $1,000,000 of drum sets that had related variable expenses of $400,000. Iverson had $660,000 of fixed expenses during the period, resulting in a loss of $60,000.

What is your current financial priority?

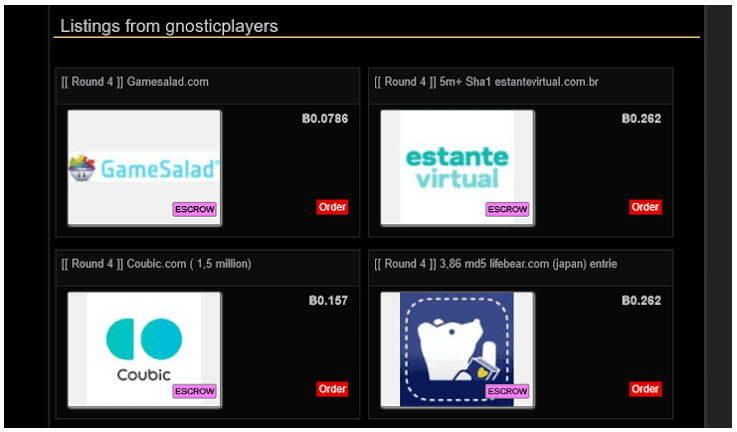

The variable costs equal $6 because the company pays $4 to manufacture each unit and $2 for the labor to create the unit. Increase revenue by selling more units, raising product prices, shrinking product size while keeping the same cost, or focusing on selling products with high margins. Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity. Fixed and variable costs are expenses your company accrues from operating the business. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits.