However, lenders may offer a lower interest rate if the DSCR is higher, as it indicates that the borrower is more likely to be able to make their loan payments. Lenders also look at other metrics, such as the loan-to-value ratio (LTV) and debt yield, when determining the interest rate of a CMBS loan. For CMBS loans, most properties must have a minimum DSCR of at least 1.25x, though some lenders may permit as low as 1.20x for certain property types. Risker property classes, such as hotels, typically have higher DSCR requirements; most lenders require at least a 1.40x to 1.50x DSCR for hotel properties to be eligible for CMBS financing.

All in all, the DSCR is a very important factor when it comes to commercial real estate. Any lender considering financing a property will want a buffer to ensure their debt is paid and that the business can pay it back. In commercial real estate, many businesses may look to finance new properties to either start or expand business. The first thing many lenders look at when deciding to finance a property is the DSCR to determine if they are willing to lend and if so, how much they are willing to lend. The DSCR is super important as it helps lenders evaluate how much they can lend and get repaid without the business defaulting as well as how much of a mortgage a property can carry.

Different Kinds of DSCR Calculations

While it may be a simple calculation, an investor will need to make sure they are using the correct figures for a property to get an accurate result. Read about how fully amortized loans work, what they’re for and what the payments consist of. Apply online for expert recommendations with real interest rates and payments. Let’s take a project that has a constant revenue stream over time, but with variable cost profile, producing a profiled CFADS. The means our DSCR is also a lumpy profile over the project, even going below 1.00 in two years. However, once she has the mortgage, applying for another one can be difficult, as her DSCR number will decrease every time she takes on a new loan.

In each real estate transaction, there are a lot of components and moving parts that help move a sale and purchase along and everything that comes along with them. It’s important to note that some lenders and financial professionals use different versions of this formula to calculate DSCR. For example, the Corporate Finance Institute (CFI) outlines the DSCR formula using EBITDA — short for earnings before interest, taxes, depreciation and amortization — in place of net operating income. If you’re calculating DSCR to understand your company’s income vs. debts, make sure to be consistent with the formula you choose.

The need for the ratio

Additionally, a low DSCR can indicate that a company is struggling to generate enough cash flow to cover its debt obligations, which can lead to financial distress and potential bankruptcy. Therefore, it is crucial for companies to maintain a strong DSCR to ensure their financial stability and access to funding. One important thing to note is that a debt service coverage ratio of less than 1 indicates that the company is not generating enough cash flow to cover its debt obligations. This can be a red flag for lenders and may make it difficult for the company to secure additional financing. In the realm of financial management, one of the most critical calculations that is used to establish a company’s financial health and capabilities is the debt service coverage ratio (DSCR).

BDC Credit Profiles Holding Up as Unsecured Debt Markets Re-Open – Fitch Ratings

BDC Credit Profiles Holding Up as Unsecured Debt Markets Re-Open.

Posted: Wed, 16 Aug 2023 19:47:00 GMT [source]

To calculate an entity’s debt coverage ratio, you first need to determine the entity’s net operating income (NOI). NOI is meant to reflect the true income of an entity or an operation without or before financing. Thus, not included in operating expenses are financing costs (e.g. interests from loans), personal income tax of owners/investors, capital expenditure and depreciation. Cash flow is a critical element in calculating a company’s debt service coverage ratio, as it represents the money that is available to cover debt obligations. By analyzing cash flow, lenders and financial managers can ensure that a company has the necessary resources to maintain consistent debt repayment. Companies with strong cash flow are more likely to have a high DSCR, as they have the necessary resources to cover debt obligations even during periods of uncertainty or economic downturns.

Why Lenders Use Debt Service Coverage Ratio in Loan Applications

This can be very beneficial, or very frustrating, depending on the personal financial strength of the individual in question. The debt service coverage ratio lets the lender know how to determine a borrower’s ability to pay off their DSCR mortgage. Lenders must forecast how much a real estate property can rent for so that they can predict a property’s rental value. By using debt service coverage ratio, companies and lenders can make informed financial decisions. Financial managers can use DSCR to determine whether a new loan is viable or to evaluate the financial health of an existing borrower. Lenders can use DSCR to ensure that they are investing in sound opportunities that are capable of generating reliable returns.

They want to make sure that borrowers can afford to make their monthly payments on time. If borrowers’ debts are already consuming too much of their gross monthly income, lenders will be more hesitant about approving them for a mortgage loan. If you’re interested in CMBS financing for a multifamily or commercial property, lenders will typically only look at the asset at hand — in this case, the multifamily or commercial property you want to purchase or refinance. However, if you want SBA 7(a) or SBA 504 loan to purchase owner-occupied commercial real estate, lenders will focus on the DSCR of your business itself, rather than the property. While it’s true that you can rent out a certain part of your property out to tenants (between 40% and 49% of the property for SBA 504 loans), this is much less important than the actual profitability of your business itself. A Debt service coverage ratio, or DSCR, takes the current income of a property and divides it by the property’s debt obligations.

Calculating the DSCR

She has to be sure this is what she wants, and that this location will serve her business needs for a long time to come. With a DSCR score of 1.42, Sarah is in a very good position to receive the loan. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. Insurance services are provided through First Republic Securities Company, DBA Grand Eagle Insurance Services, LLC, CA Insurance License # 0I13184. Formulating an approach to improve DSCR is important and often involves strong bookkeeping and accounting expertise. Businesses can get started with First Republic business resources such as Small Business Bookkeeping 101 and consult with First Republic financial professionals to manage their overall financial health.

- Once sculpting is completed at the structure stage, the repayments are fixed for the project.

- Real estate investors can adjust their offer on a rental property to produce a specific debt service coverage ratio, and also monitor the ratio to help tell if the time is right to refinance a rental property.

- When triggers occur, certain stopgaps will be enacted to protect the lenders.

- The underwriting process includes pre-approval, rental income verification, title search, and a final underwriting decision.

The DSCR is a measure of a business’s ability to pay off loans — the ratio of a business’s available cash flow to its debt obligations, including principal and interest payments on a loan. Once you know how to calculate DSCR, you can get a better sense of your finances and make strategic operating decisions that benefit your business. The interest coverage ratio shows how many times an organization’s operating profit will pay for just the interest on its debts. This approach varies from the debt service coverage ratio, which also addresses the ability of a company to pay the principal portion of its debts. As such, the debt service coverage ratio is more realistic, except in cases where a business does not have to pay any principal within the next year – in which case the results of the two measures should be the same. In both situations, if the ratios result in a figure of less than 1, then the entity is not generating sufficient income to pay for its ongoing debt obligations, making it a risky borrower for any prospective lender.

How can I improve my DSCR to qualify for a CMBS loan?

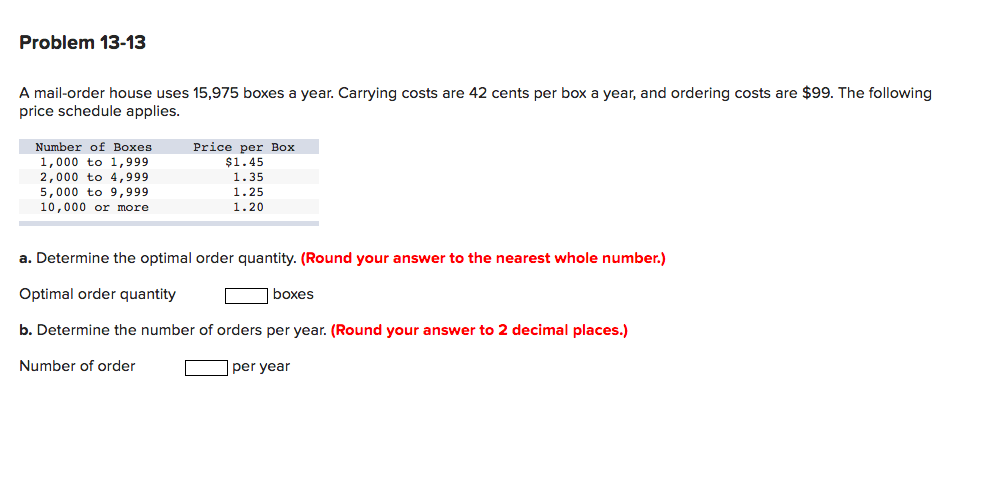

More systems are A-rated, and the median debt service coverage ratio for those systems in 2015 was 2.0. It is not dissimilar to when one applies for a mortgage to purchase real estate. Banks look at your ability to pay the mortgage based on ratios that look at your income and how much of it you are already committed to for ongoing loans. Net operating income or NOI, for example, is typically calculated using earnings before interest, taxes, depreciation, and amortization (EBITDA) for DSCR calculations. This means that taxes, interest, and other costs from the NOI calculation should not be deducted before entering it into the DSCR formula. Calculate your property’s debt service coverage ratio by using the calculator below.

Our seasoned bankers tap their specialized industry knowledge to craft customized solutions that meet the financial needs of your business. Delivering a personal approach to banking, we strive to identify financial solutions to fit your individual needs. And of course, just because the DSCR is less than 1 for some loans,

this does not necessarily mean they will default. Once you know how to format the formula in Excel, you can analyze the DSCR of various companies to compare and contrast before choosing to invest in one of those stocks. In the example below, Sun Country, Inc. entered into an agreement with the U.S. As part of the loan and guarantee agreement, Sun Country agreed to several financial covenants.

The amount of interest paid on long-term debt — a related subject — is also a factor since interest is tax-deductible and principal is not. The debt-service coverage ratio (DSCR) is an often-overlooked but critical element of business success. In its simplest form, the ratio gauges the ability of a business to repay its loans. The debt-service ratio, however, isn’t just a metric for investors; it can also affect whether a business can get a loan and how much it will have to pay to borrow money. While DSCR loans may not have the exact same requirements as Conventional mortgages, there are still guidelines real estate investors will have to meet to qualify. Rather than looking at a borrower’s income, we consider the expected monthly rent from the property.

To learn more about your multifamily loan options, fill out the form below to speak to a specialist. A DSCR of less than one means that the cashflows from the project are not strong enough to support the level of debt. CEO of Global Financial Svc, Global Financial Training Program, Global Church Financing. Some businesses require constant reinvestment in order to remain competitive. Since your DSCR is all about how your income compares to your debt, you’ll need to work on increasing profits or reducing debt (or, better yet, both) in order to raise your DSCR. Of course, these are areas of your business that you’re likely already focused on, so you may need to take a slightly different approach.

Fitch Revises Buckner Retirement Services (TX) Outlook to Negative … – Fitch Ratings

Fitch Revises Buckner Retirement Services (TX) Outlook to Negative ….

Posted: Tue, 08 Aug 2023 07:00:00 GMT [source]

As mentioned above, DSCR loans are a type of mortgage used by real estate investors to purchase property without having to show proof of income. The loans are made by looking at the potential income that a property could bring, instead of the income that an investor is making right now. 6 month SOFR DSCR loans are a variation on this financing option where the loan is packaged as an adjustable rate mortgage with an interest rate that changes based on the SOFR index.

Once this is done, we will have a constant DSCR forecasted ensuring that a lower principal repayment is applied in a period with lower CFADS. Once sculpting is completed at the structure stage, the repayments are fixed for the project. However, if you own a small business and would like to use an SBA loan, like the SBA 7(a) or SBA 504 loan, the actual DSCR of your business will be of importance as well.

DSCR can be calculated by dividing a property’s net operating income (NOI), with its annual debt service (including principal, interest, taxes, and related costs). The debt service coverage ratio is a ratio of a property’s annual gross rental income and its annual mortgage debt, including principal, interest, taxes, insurance, and HOA (if applicable). Lenders use DSCR to analyze how much of a loan can be supported by the income coming from the property as well as to determine how much income coverage there will be at a specific loan amount. Lenders do not take into account expenses such as management, maintenance, utilities, vacancy rate, or repairs in the debt-service-coverage ratio calculation. The debt service coverage ratio (DSCR), known as “debt coverage ratio” (DCR), is a financial metric used to assess an entity’s ability to generate enough cash to cover its debt service obligations.