These financial accounts thoroughly analyze the church’s earnings, outlays, assets, liabilities, and overall financial performance throughout the given time frame. Church financial management is essential in overall church management because it ensures the prudent stewardship of financial resources to support the church’s mission and goals. Leaders in the church plan for future growth and development, assign resources to different ministries, and uphold accountability and openness to the congregation https://www.bookstime.com/articles/what-are-t-accounts by managing the church’s finances well. Churches fulfill their religious and community service obligations because of their financial stability and careful budgeting, which helps to build members’ confidence. Church financial management is an integral part of church management, essential to maintaining the congregation’s and the church’s temporal and spiritual well-being. Accurate and timely financial reporting is crucial for maintaining transparency and accountability within the church.

Bookkeeping for Churches: How to Balance Faith and Finances

As a nonprofit organization, make sure to do your homework and seek professional accounting advice on how these can benefit your church. As a church, you don’t need to worry about paying taxes in the same way that a for-profit business does. However, there are plenty of rules and regulations that church accounting guidelines you still need to follow. Unsurprisingly, this is another area where having a healthy accounting structure in place can make everything much easier. For example, all church accountants (especially in the United States) should be aware of and follow General Accepted Accounting Principles (GAAP).

- From fund accounting methods to ERTC programs, you want to have a church-specific accounting focus.

- Spreadsheet Package–this includes an automatic accounting workbook for up to 5 funds, a contribution tracking workbook, a travel reimbursement workbook, and more.

- Every well-organized house needs a blueprint, and so does your church’s accounting system.

- And a well-defined chart of accounts keeps your finances organized, making it easier to record transactions, generate reports and identify trends.

- It helps committee members assess the church’s financial situation and make well-informed choices to progress the mission and financial stability of the congregation.

What is Bookkeeping For Churches?

Regularly updating donors on how their contributions are being used can significantly enhance this trust. This can be achieved through detailed reports, newsletters, or even dedicated sections in church services that highlight ongoing projects and their funding status. By keeping donors informed, churches not only demonstrate accountability but also encourage continued and increased giving.

Fund Accounting

Fund accounting is a specialized system used by non-profit organizations, including churches, to manage and report their financial resources. This method focuses on accountability rather than profitability, ensuring that funds are allocated and used according to specific purposes and donor restrictions. The primary objective is to provide a clear and transparent view of how resources are being utilized to fulfill the organization’s mission. It will record income and expenses, reconcile bank accounts, and manage budgets. It will also provide a clear and organized view of your church’s financial health, which will help facilitate informed decision-making and ensure accurate financial reporting. In the unhappy circumstance where they are – well, church accounting guidelines are your solution.

- It includes income from investments, grants, rental properties, fundraising events, and endowment money.

- Instead of adding this extra responsibility to your plate, reach out to a professional church bookkeeper.

- The responsibility of managing church finances sensibly and in a way that is consistent with the congregation’s values and goals is emphasized by responsible stewardship.

- Reports on donor contributions guarantee that all tithes and donations are appropriately recorded.

- As you go about all of this great work, sometimes financial management ends up taking a backseat.

- These financial accounts thoroughly analyze the church’s earnings, outlays, assets, liabilities, and overall financial performance throughout the given time frame.

Financial Reporting Requirements for Churches

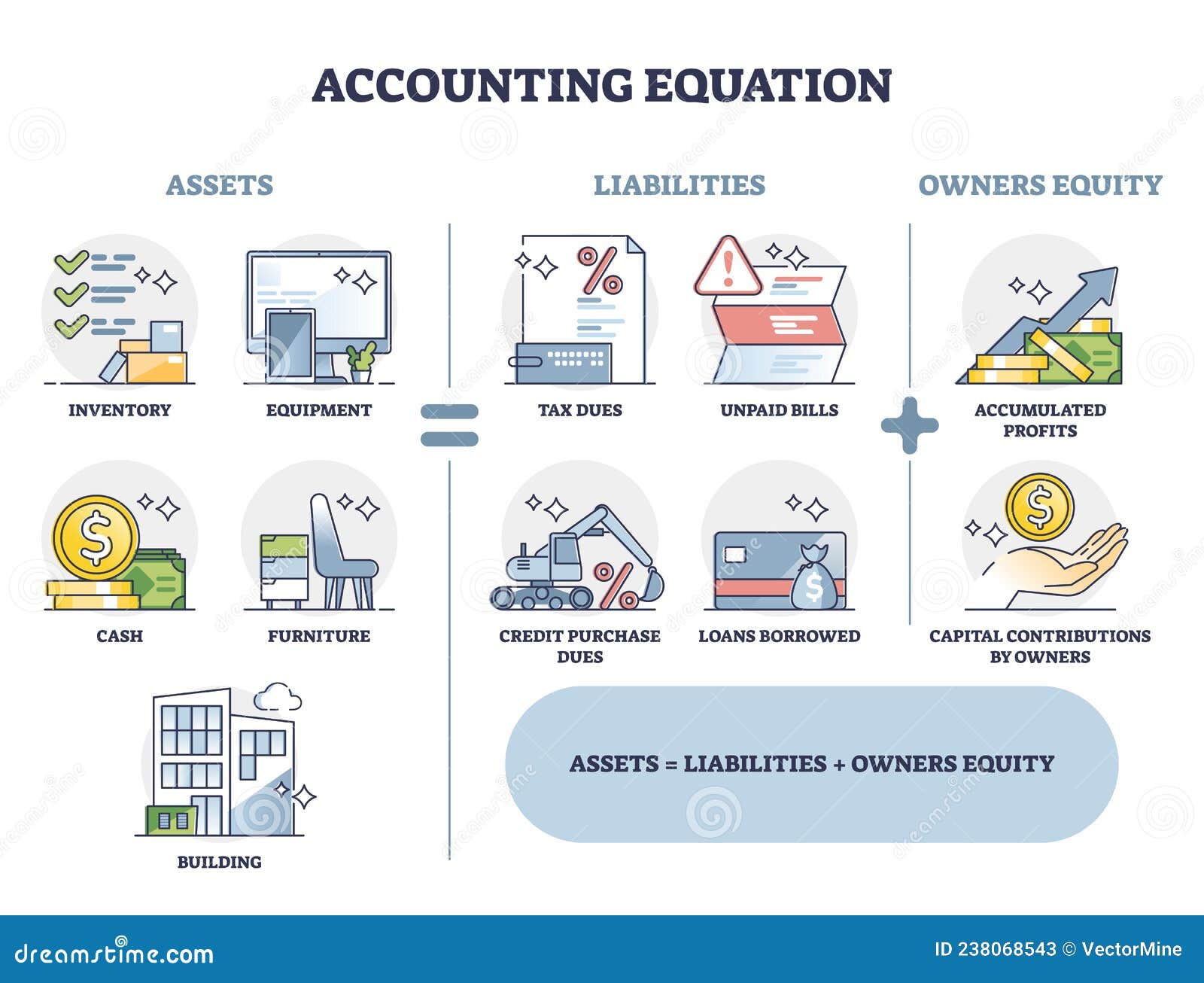

Having a dedicated church finance committee can greatly aid in overseeing these responsibilities and ensuring compliance. By following some key practices, you can ensure your church remains compliant and avoids unnecessary penalties. Here are three essential recommendations to help you maintain regulatory and tax compliance. The General Ledger is the central repository for all financial transactions. It includes detailed entries for income, expenses, assets, and liabilities, supporting the preparation of financial statements and ensuring comprehensive financial tracking.

Bank Reconciliation Statement

There are multiple methods that you can employ when engaging in accounting as an organization. Where this matters, as far as accounting is concerned, is the way you track and manage everything. From accounting methods to reporting (both of which we’ll discuss further down in this piece), everything is smoother when you understand where your money is coming from in the first place. While we’ll cover taxes in detail in a bit, there are clear benefits as it relates to reporting to Uncle Sam when it comes to accounting in churches. Things like the number of first-time churchgoers or baptisms reflect healthy church growth. To be clear, you don’t want to emphasize cash flow as a church success benchmark.

How To Create A Church Operating Budget

Regularly review your church activities and financial practices to ensure they align with compliance regulations. My team and I (besides being stellar writers) are pastors and church leaders. We know how crucial the right software is, and how daunting it can be to find it. To that end, we’ve invested in deep research and tested, evaluated and ranked this year’s very best church accounting software. A church’s financial committee is usually made up of members who were assigned or elected to steward the church’s financial resources.

Intro to Church Accounting: Guidelines, Case Study, and Best Practices

These reports should be presented each quarter, and should be written in a way that is easily understood. Church leaders should also have access to review these reports and ask questions if something seems amiss. Long-term financial planning entails setting up and managing endowments or reserve funds. These funds act as a safety net for the church’s finances, assisting it in navigating unforeseen costs, downturns in the economy, or significant projects.

Best Worship Conferences for Church Leaders in 2024

Ensure all your funds are allocated to proper budgets and purposes (e.g., Children’s Ministry, Missions, Building funds). This will avoid any confusion and ensure that money is being used as intended. This will maintain transparency with the congregation and ensure that you have a clear picture of your church’s financial activity. Let’s explore the essential guidelines and best practices every church should follow to maintain financial integrity. If your church doesn’t already offer online giving, now is the perfect time to start! Studies show that adding an online giving solution dramatically increases overall giving by an average of 32%!