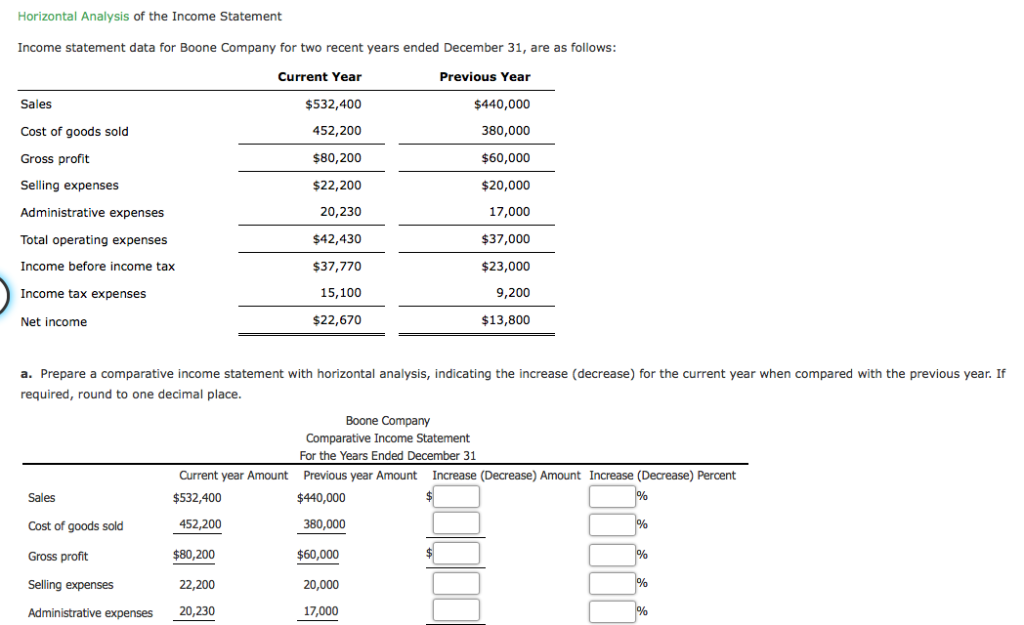

For example, if a company’s current year (2022) revenue is $50 million in 2022 and its revenue in the base period, 2021, was $40 million, the net difference between the two periods is $10 million. Ratios such as earnings per share, return on assets, and return on equity are similarly invaluable. These ratios make problems related to the growth and profitability of a company evident and clear. However, the percentage increase in sales was greater than the percentage increase in the cost of sales.

Essential Insights – 2024 AI In Finance Survey

- Conversely, if expenses are growing faster than revenue, it may signal potential issues that need to be addressed.

- Analyze how these elements reflect a company’s profitability, efficiency, and growth potential.

- The total assets as of March 2024 were ₹ 1,14,790.60 Crores compared to ₹ 1,17,113.70 Crores as of March 2023.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in breast cancer areas of personal finance and hold many advanced degrees and certifications. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Horizontal Analysis of Financial Statements

For horizontal analysis, it’s best to take several years of historical data to gain useful insights into how a company is performing. The horizontal analysis relies heavily on historical data, which may not accurately reflect future performance. It doesn’t account for external factors or industry changes that may impact financial results.

Calculate Percentage Change

To this, additional gains were added and losses were subtracted, including $257 million in income tax. As a working professional, business owner, entrepreneur, or investor, knowing how to read and analyze data from an income statement—one of the most important financial documents companies produce—is a critical skill to have. If certain historical eras of underperformance are chosen as a comparison, horizontal analysis can be used to make the current period appear better. The presentation of the changes from year to year for each line item can be analyzed to see where positive progress is occurring over time, such as increases in revenue and profit and decreases in cost.

A more useful horizontal analysis can be undertaken by setting one year as the base year, and then calculating each line item for the other years as a percentage of the base year. A) The company has improved its core business operations.B) The increase may not be sustainable in the long term.C) The company’s operating expenses have decreased significantly.D) The increase is likely due to a reduction in tax expenses. If anything, they only let you stay in compliance with regulatory standards such as GAAP. You also need to reliably understand how your business is fairing and this is where financial statement analysis comes in. Above, you are presented a comparative retained earning statement for the years 2020 and 2021.

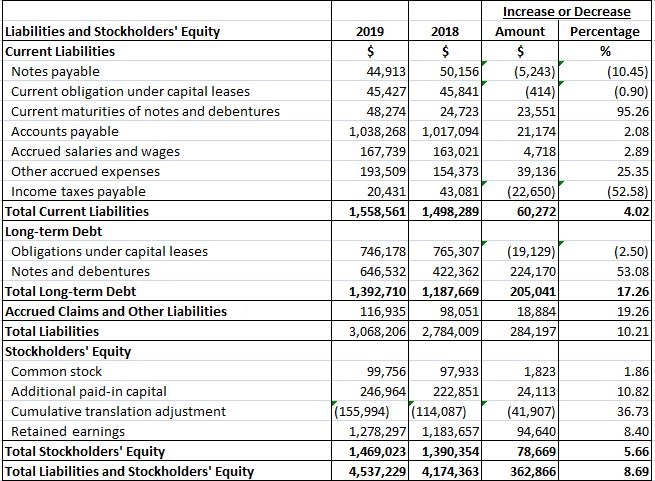

It helps assess the composition and proportion of different components within financial statements. Horizontal analysis, on the other hand, compares financial data across multiple periods to analyze trends, changes, and growth rates. To conduct horizontal analysis i.e. evaluate underlying trends, it’s essential to compare financial statements of a company or companies over two or more accounting periods. Horizontal analysis allows investors and analysts to see what has been driving a company’s financial performance over several years and to spot trends and growth patterns. This type of analysis enables analysts to assess relative changes in different line items over time and project them into the future.

Using consistent accounting principles like GAAP ensures consistency and the ability to accurately review a company’s financial statements over time. Comparability is the ability to review two or more different companies’ financials as a benchmarking exercise. Horizontal analysis involves looking at Financial Statements over time in order to spot trends and changes.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

This can be useful in identifying areas of concern for a business, as well as improving the performance of companies that are struggling. Different ratios, such as earnings per share (EPS) or current ratio, are also compared for different accounting periods. Vertical analysis serves as a more feasible technique compared to horizontal analysis. It is also useful for inter-firm or inter-departmental performance comparisons as one can see relative proportions of account balances, regardless of the size of the business or department. As seen from the above example, every ratio is given in relation to the revenue in the case of income statement.