.jpeg)

But the calculation itself does not give any indication of how likely that kind of return will be. Accurate ROI calculations depend on factoring in all costs, not merely the initial cost of the investment itself. Transaction costs, taxes, maintenance costs and other ancillary expenditures need to be baked into your calculations. If one investment had an ROI of 20% over five years and another had an ROI of 15% over two years, the basic ROI calculation cannot help you determine which investment was best. When you put money into an investment or a business endeavor, ROI helps you understand how much profit or loss your investment has earned.

The Formula for RoR

For example, if a business owner is considering expanding into a new product line, the ROI formula can be used to chart out its costs and estimate its potential returns. If an entrepreneur is evaluating a new project, an ROI calculation can help determine if the likely return is worth the expense. If an investor is evaluating past or future stock purchases, the ROI formula is a quick indicator of real or potential stock performance. The internal rate of return (IRR) also measures the performance of investments or projects, but while ROR shows the total growth since the start of the project, IRR shows the annual growth rate. The Compound Annual Growth Rate (CAGR) is another metric that shows the annual growth rate of an investment, but this time taking into account the effect of compound interest.

However, the scenario gets more complex if additional deposits or withdrawals are made during the year. For instance, if you made a $5,000 deposit, the year-end balance would go up to $18,350. Ignoring this deposit would skew the ROI, making it seem the account earned $8,350 in market gains and dividends—not including any fees or commissions. The correct approach is subtracting the $5,000 deposit, leaving only the original $13,350 year-end balance for a better ROI calculation.

- We’re making good progress, having one way to compare our returns to others and another for gauging our financial decisions.

- Otherwise, you’ll probably want to avoid this situation as it can drastically undercut your returns.

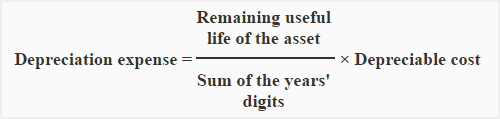

- When calculating the rate of return, you are determining the percentage change from the beginning of the period until the end.

- The goal of ROI is to determine the precise return of an investment given that investment’s cost.

- The importance of portfolio returns can change significantly depending on the life stage an investor is in.

ROI fails to reflect the time value of money, for instance, and it can be difficult to meaningfully compare ROIs because some investments will take longer to generate a profit than others. For this reason, professional investors tend to use other metrics, such as net present value (NPV) or the internal rate of return (IRR). Benchmarks serve as your point of reference against which portfolio returns are evaluated.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

The Return on Investment (ROI) is a profitability ratio that compares the net profits received at exit to the original cost of an investment, expressed as a percentage. Basically, return on investment (ROI) tells you how much money you’ve made (or lost) on an investment or project after accounting for its cost. Determining what constitutes a “good” ROI is crucial for investors seeking to maximize their returns while managing risk.

The Financial Modeling Certification

In essence, it measures the gain or loss made on an investment relative to the amount of money invested. This type of ROI calculation is more complicated because it involves using the internal rate of return (IRR) function in a spreadsheet or calculator. When evaluating a business proposal, it’s possible that you will be contending with unequal cash flows.

In finance, Return on Investment, usually abbreviated as ROI, is a common, widespread metric used to evaluate the forecasted profitability on different investments. Before any serious investment opportunities are even considered, ROI is a solid base from which to go forth. The metric can be applied to anything from stocks, real estate, employees, to even a sheep farm; anything that has a cost with the potential to derive gains from can have an ROI assigned to it. While much more intricate formulas exist to help calculate the rate of return on investments accurately, ROI is lauded and still widely used due to its simplicity and broad usage as a quick-and-dirty method.

.jpeg)

Finally, to calculate ROI with the highest degree of accuracy, total returns and total costs should be considered. For an apples-to-apples comparison between competing investments, annualized ROI should be considered. A good return on investment is generally considered to be about 7% per year, which is also the average annual return of the S&P 500, adjusting for inflation. Financial advisors typically recommend people invest in low-cost, diversified investments, like index funds and ETFs.

An annualized total return provides only a snapshot of an investment’s performance and does not give investors any indication of its volatility or price fluctuations. If an investment doesn’t have a solid ROI, it may be a good time to rebalance your portfolio and sell off some assets that aren’t doing well. But it’s important to consider any transaction costs and effects on your overall returns in the long run. That’s because most people are used to seeing annual returns rather than monthly ones.

While the metric provides a useful snapshot of an investment’s performance, it does not reveal volatility and price fluctuations. Return on investment (ROI) is a ratio that measures the profitability of an investment by how to buy parsiq comparing the gain or loss to its cost. It helps assess the potential return of investments on things like stocks or business ventures.

Additionally, calculating the net asset value (NAV) for each position during bitcoin price charts and news 2021 the chosen time frame is vital. NAV provides an asset’s worth, accounting for fluctuations in the market and other variables. While TWR and MWR offer a view of your pretax returns, you’ll want to calculate the after-tax impact for a sense of what you’re actually gaining. And lastly, it’s important to remember that a portfolio typically includes a mix of diverse asset classes, each carrying its own risk and return profile.

Compound interest is the engine that powers your investment returns over time. With compound interest, the amount you how to add bitcoin to your isa and profit tax earn each year grows can be reinvested in your account to help you earn more. The time horizon must also be considered when you want to compare the ROI of two investments. An investor needs to look at the true ROI, which accounts for all possible costs incurred when each investment increases in value.