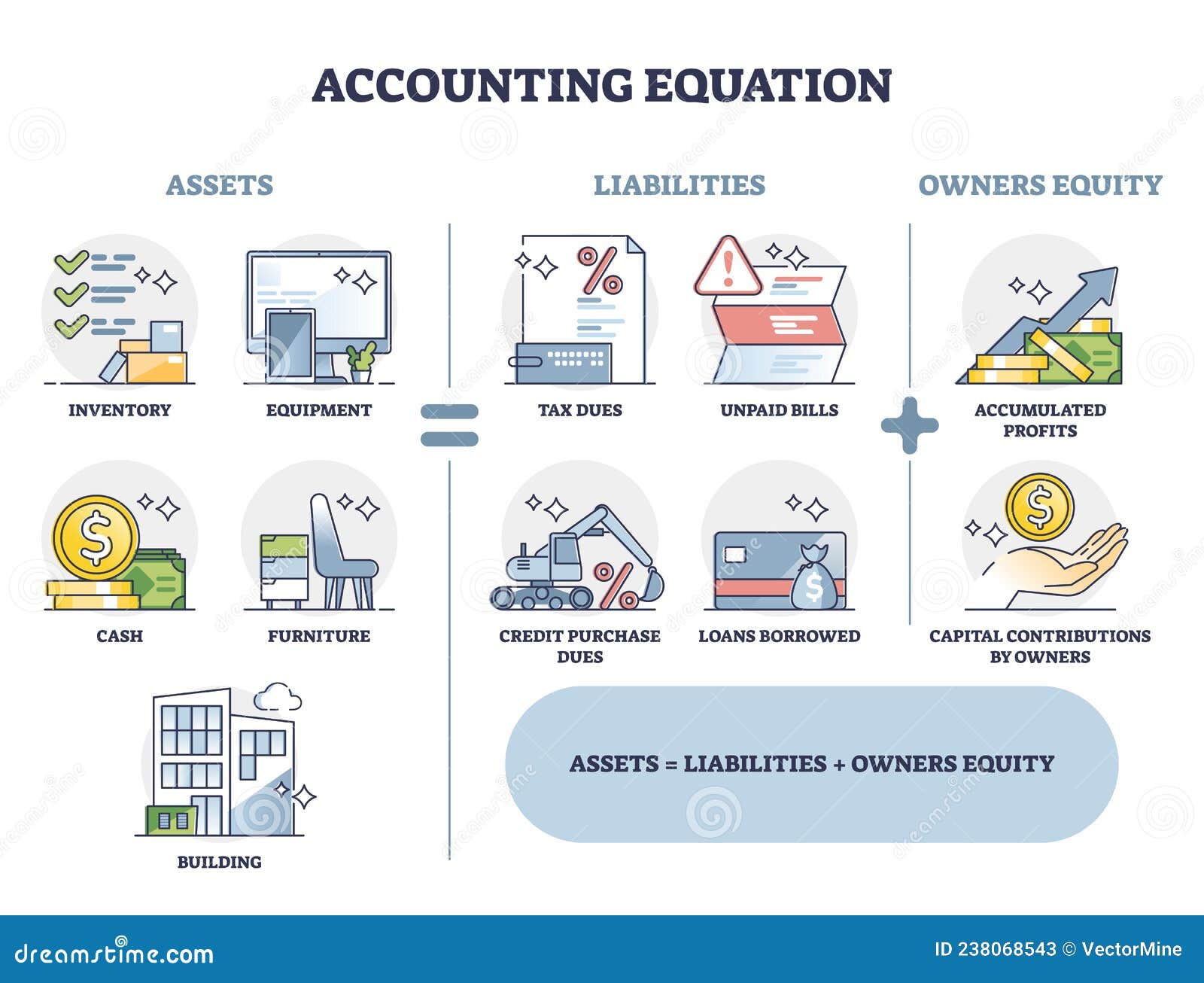

The total equity amount reflects the company’s net worth or book value, which is the value of the assets minus the liabilities. Current assets are a contribution margin company’s possessions it plans to convert into cash or use up within a year, like cash, inventory, and accounts receivable. Non-current assets are things a company owns but won’t convert to cash shortly, like property, equipment, and long-term investments. You’ll notice that each account in the chart of accounts for Doris Orthodontics also has a five-digit reference number preceding it.

Non-Operating Revenues and Expenses, Gains, and Losses

It’s also worth saying that depending on the idustry and a business’s structure, more accounts can form the COA. The chart of accounts is important because it allows you to organize your company’s financial data and distill it into clear and logical categories. Current liabilities are obligations due within one year or the company’s operating cycle, whichever is longer. They represent short-term debts or obligations that need to be settled in the near future. Current liabilities reflect your short-term financial obligations and your company’s ability to meet them.

ERP Selection Guide and Checklist: Find the Perfect ERP for Your Business

The bookkeeper would be able to tell the difference by the account number. An asset would have the prefix of 1 and an expense would have a prefix of 5. This structure can avoid confusion in the bookkeeper process and ensure the proper account is selected when recording transactions. The reports play a crucial role in both the monthly financial management and the annual financial review process. To better understand how your current liabilities – credit lines, wages, etc. – should be organized, here’s an example of accounts that would fall under this category and how they might be numbered.

Asset accounts

The code can be expanded to three digits if there are more than 99 subsidiaries. Asset accounts can be confusing because they not only track what you paid for each asset, but they also follow processes like depreciation. Accounting systems have a general ledger where you record your accounts to help balance your books. Keeping your accounts in place and up-to-date is important for analyzing your finances. There are a few things that you should keep in mind when you are building a chart of accounts for your business.

For example, if you rent, the money will move from your cash account to a rent expense account. For instance, if you rent, the money moves from your cash account to the rent expense account. Expense accounts allow you to keep track of money that you no longer have. If you don’t leave sample chart of accounts numbering gaps in between each number, you won’t be able to add new accounts in the right order. For example, assume your cash account is and your accounts receivable account is 1-002, now you want to add a petty cash account.

Where does the revenue show up?

At this point, they demanded a more structured and standardized approach to accounting to help them track their finances, manage inventories, control costs, and assess their financial performance. Accounting software can facilitate standardization, providing pre-defined templates that align with generally accepted accounting principles (GAAP). This helps ensure consistency and comparability in financial reporting. Expenses are typically found on the income statement alongside revenue. Expenses are subtracted from revenue to calculate net income – the company’s profit or loss in the period in question.

In manufacturing, the production process involves different stages, such as raw materials, work in progress, and finished goods. TYou can keep track of these stages with the Raw materials inventory, Work-in-progress inventory, and Finished goods inventory accounts, monitoring the value at each production step. Expenses are the means a company spends to generate revenue and operate its business. They can be the money spent on resources and activities necessary to keep the business running smoothly.

- A chart of accounts organizes your finances into a streamlined system of numbered accounts.

- Now that we have the high-level information behind us, let’s roll up our sleeves a bit and zero in on building the ideal chart of accounts for your company.

- We often call the assets, liabiliies and equity accounts the balance sheet accounts, as they participate in forming a company’s balance sheet.

- Simply put, without an informative chart of accounts that’s customized to your particular needs, your decision-makers are leading your organization with blinders on.

- Here are tips for how to do this, plus details about what a COA is, examples of a COA and more.

- You have the option of assigning each account in the chart of accounts its own unique number, which helps with easy identification and reference.

Keeping an updated COA on hand will provide a good overview of your business’s financial health in a sharable format you can send to potential investors and shareholders. If you’re using accounting software and want to set up a customized chart of accounts, you can add or edit parent and sub-accounts to the existing default chart of accounts. Doing this will help you stay organized and better understand how your business is doing financially. Charts of accounts are an index, or list, of the various financial accounts that can be found in your company’s general ledger. These accounts are separated into different categories, including revenue, liabilities, assets, and expenditures.