The influence of removing or adding a tax shield approach is impacted by the optimal capital structure ( mix of equity and debt funding) that the company chooses. Also, the interest expense is tax-deductible on the debt which makes the selection of debt funding cheaper. However, the company bookkeeping and payroll services cannot raise the maximum funds from debt since it increases the financial risk. However, the interest paid on these debts is tax-deductible, thus making it an attractive proposition by creating a shield against a portion of the taxable income. Hence, the Tax Shield Formula plays an instrumental role in taxation and investment planning by providing measurable benefits to individuals and corporations.

Examples of non-deductible business expenses

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. Therefore, the 1st option is better since it offers a lower cost of acquisition.

Formula to Calculate Tax Shield (Depreciation & Interest)

Assuming a straight-line depreciation method, the business can deduct $5,000 ($50,000 divided by 10) from its taxable income each year for ten years as a depreciation expense. Simply multiply the cost of debt and the yield on preferred stock with the proportion of debt and preferred stock in a company’s capital structure, respectively. Since interest payments are tax-deductible, the cost of debt needs to be multiplied by (1 – tax rate), which is referred to as the value of the tax shield.

- This means that the company’s tax liability would be reduced by $30,000 due to the deduction of interest expense on debt.

- For funding their expansion and growth plans, companies often prefer debt over equity capital.

- It’s important to note that the tax shield value may vary depending on the type of expense or cost being deducted and the tax rate.

- This can help to improve the company’s financial performance and increase shareholder value.

- The formula for tax shields is very simple, and it is calculated by first adding the different tax-deductible expenses and then multiplying the result by the tax rate.

- A 25 % depreciation for plant and machinery is available on accelerated depreciation basis as Income tax exemption.

Tax shields bring down the overall amount of taxes owed by an individual taxpayer or a business. These deductions reduce a taxpayer’s taxable income for a given year or defer income taxes into future years. The benefit of using depreciation with a tax shield is that you can subtract any depreciation expenses from taxable income. It can also depend on the type of taxable expenses being used as a tax shield. The interest tax shield has to do with the tax savings you can receive from deducting various interest expenses on debt. In other words, the tax shield protects part of the taxpayers income from being taxed.

How often should I calculate my tax shield?

For example, if a company has an annual depreciation of $2,000 and the rate of tax is set at 10%, the tax savings for the period is $200. This machinery has an estimated useful life of 10 years and a salvage value of $10,000. Suppose the company has an interest expense of $7 million and a 25% effective tax rate. As the name suggests and discussed earlier, the interest tax shield approach refers to the deduction claimed in the tax burden due to the interest expenses. This explains that if an individual or corporation has a loan or mortgages and are paying interest on the same.

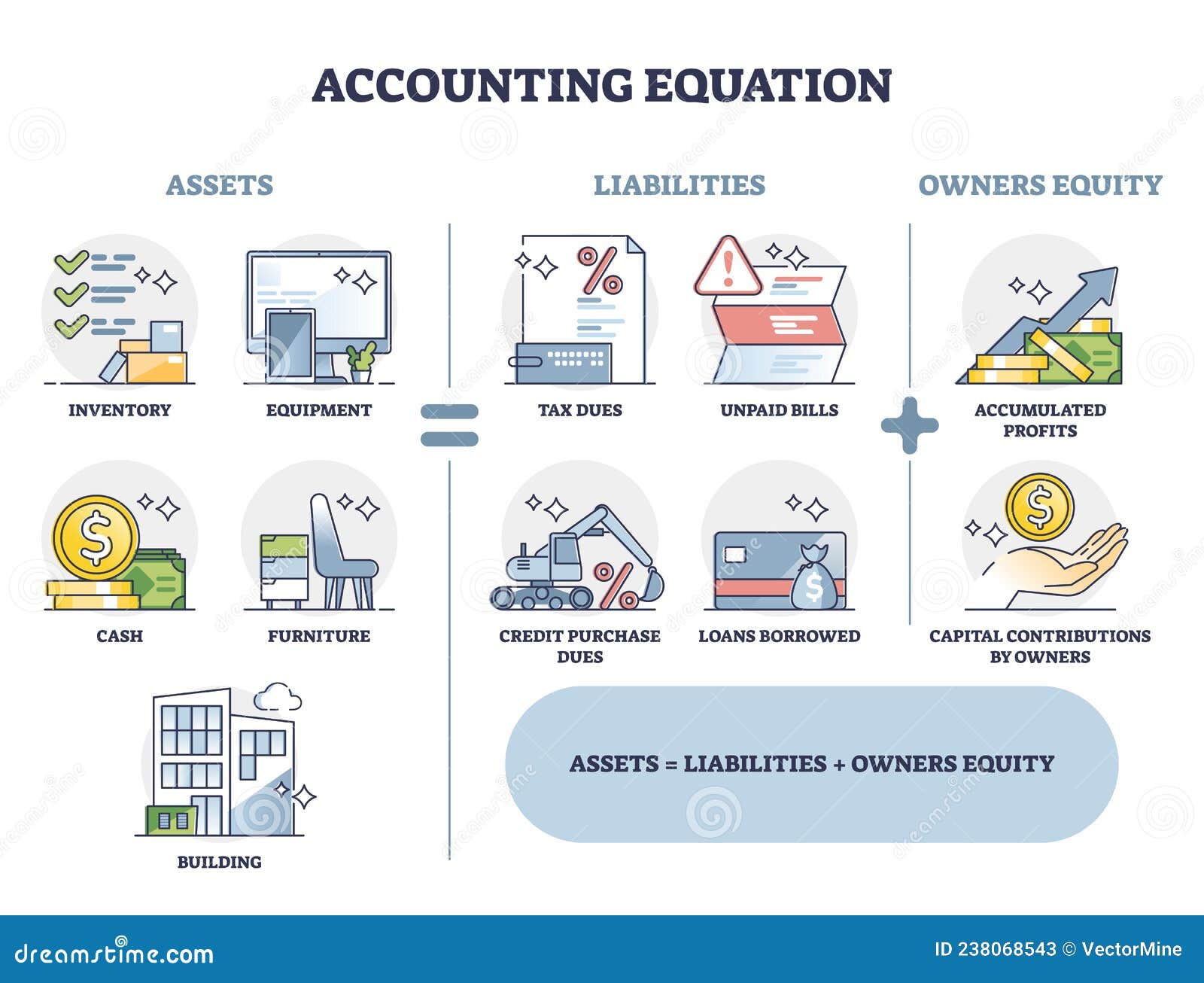

As a result, companies may choose to finance their operations through debt rather than equity to take advantage of this tax shield. A tax shield works by reducing a company’s taxable income, which in turn reduces the amount of taxes owed. The tax shield is created by deducting certain expenses and costs from a company’s taxable income, which reduces the amount of income subject to taxation. A company’s taxable income is decreased by the interest paid that is deductible on debt commitments. The overall amount of tax the company owes subsequently lowers as a result. However, only situations in which the company’s earnings, specifically its earnings before interest and taxes (EBIT), exceed its actual interest expenses qualify for the tax shield.

How to calculate the tax shield?

The interest tax shield is positive when the EBIT is greater than the payment of interest. Moreover, this must be noted that interest tax shield value is the present value of all the interest tax shield. Let’s construct the income statements of two companies and make a comparison of both.

Although tax shield can be claimed for a charitable contribution, medical expenditure, etc., it is primarily used for interest and depreciation expenses in a company. Therefore, the tax shield can be specifically represented as tax-deductible expenses. Like the tax shield offered in compensation for medical expenses, charitable giving can likewise bring down a taxpayer’s obligations. To qualify, the taxpayer must utilize itemized deductions on his tax return. The deductible amount might be all around as high as 60 percent of the taxpayer’s adjusted gross income, contingent upon the specific conditions.

Taxpayers can contribute to retirement accounts, such as traditional IRAs, 401(k)s, and 403(b)s, and deduct the contributions from their taxable income. You have a little bit of flexibility with a tax shield since you have an opportunity to reduce taxable income for a specific tax year. Alternatively, you have the opportunity to move it forward to a future point in time.

- An individual may deduct any amount attributed to medical or dental expenses that exceeds 7.5% of adjusted gross income by filing Schedule A.

- Interest that a person pays on debt or a loan carried on the financial statement or balance sheet is tax-deductible.

- These deductions reduce a taxpayer’s taxable income for a given year or defer income taxes into future years.

- By addressing these FAQs, users can gain a better understanding of tax shields, how to utilize the calculator effectively, and the broader context of financial planning for tax optimization.

- Taxpayers can either reduce their taxable income for a specific year or choose to defer their income taxes to some point in the future.

- By doing so, you can make informed financial decisions and potentially better secure your financial future.

Taxpayers should consult with a tax professional or accountant to determine which tax shields are available to them and how they can best take advantage of these benefits. The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth. It also provides incentives to those interested in purchasing a home by providing a specific tax benefit to the borrower. For example, if an individual has $2000 as mortgage interest with a tax rate of 10%, then the tax Accounting For Architects shield approach will be worth $ 200.

How Tax Shields Work

This means the business would have saved $15,000 in taxes due to the depreciation tax shield. Let’s consider a practical example to see how a tax shield works in real life. Imagine a small business that invests in machinery for production purposes. The cost of the machinery is $50,000, and it has an expected useful life of 10 years.