Content

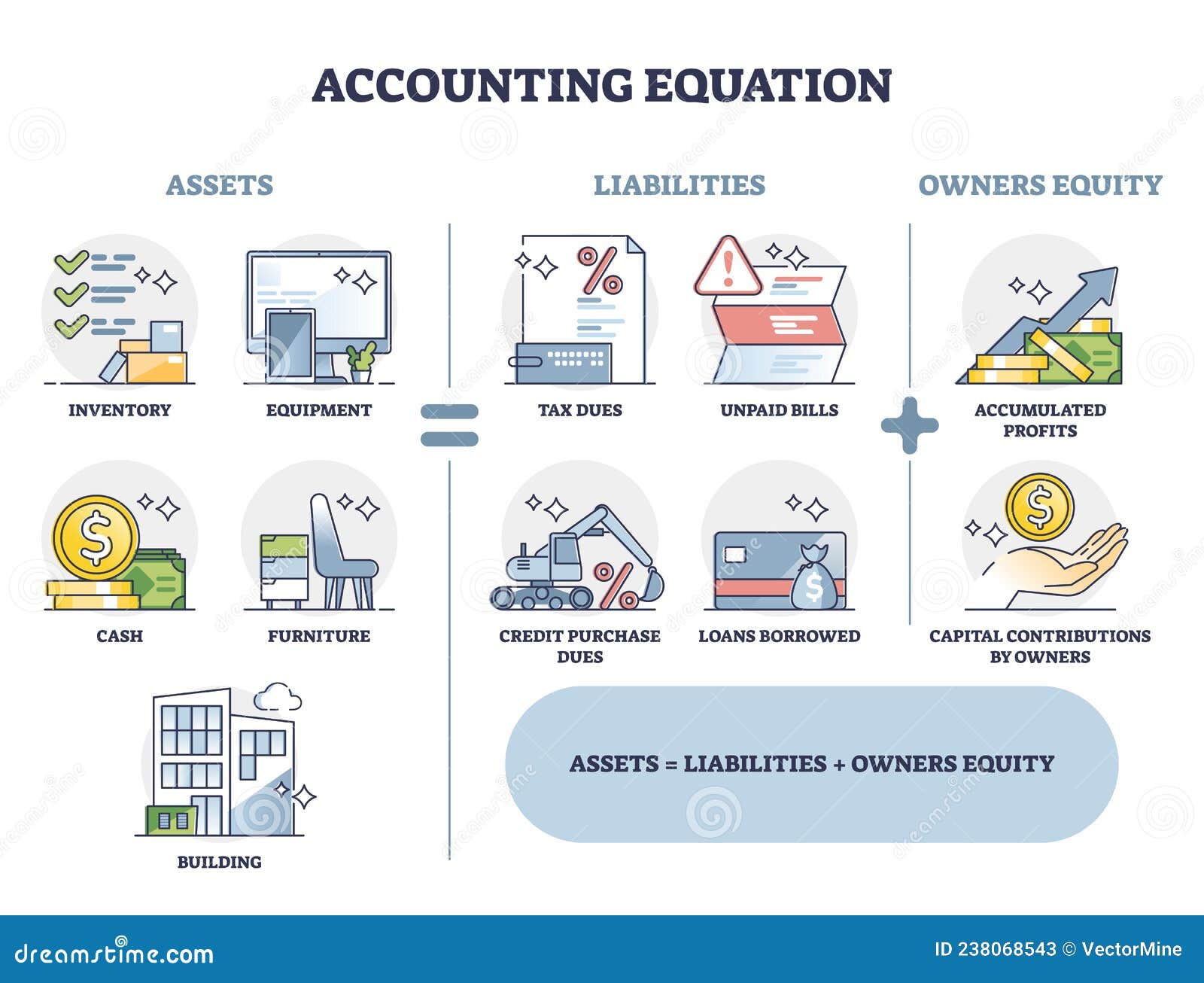

- The accounting equation formula is: Assets = Liabilities + Owners’ or Stockholders’ Equity.

- How to earn more interest in a savings account

- How to Calculate Net Profit Margin

- Assets Liabilities = Owner’s Equity-

- You’re our first priority.Every time.

- Smart Ways to Spend Your Tax Refund and Grow Your Business

Refer to the chart of accounts illustrated in the previous section. A business’s liabilities are what they owe or have to pay to continue operating the business. Debt, including long-term debt, is a liability that can be overwhelming for any company if not managed properly.

This includes expense reports, cash flow and salary and company investments. An accounting equation is a tool businesses of all sizes must use to help keep a handle on their financial health. Even if you have an accountant who handles the numbers for you, Navigating Law Firm Bookkeeping: Exploring Industry-Specific Insights you should have a basic understanding of the accounting equation. The accounting equation is the foundation of the double-entry accounting system. Therefore, the basic accounting equation helps businesses around the world create financial statements.

The accounting equation formula is: Assets = Liabilities + Owners’ or Stockholders’ Equity.

The remaining two elements, revenue and expenses, are still important (and you still need to track them) because they indicate how much money you are bringing in and how much you are spending. However, revenue and expenses are not part of the accounting equation. The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system. The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation.

Net income reported on the income statement flows into the statement of retained earnings. If a business has net income (earnings) for the period, then this will increase its retained earnings for the period. This means that revenues exceeded expenses for the period, thus increasing retained earnings.

How to earn more interest in a savings account

The business needs to consider the actual price of the computers, tax and shipping costs, consulting fees or support costs paid to purchase, plus setup and maintenance costs. ROI can be used to gauge different metrics, all of which help determine how profitable a business is. To calculate ROI with the most accuracy, total returns and total costs should be measured. During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash. Unearned revenue represents a customer’s advanced payment for a product or service that has yet to be provided by the company.

Notes receivable is similar to accounts receivable in that it is money owed to the company by a customer or other entity. The difference here is that a note typically includes interest and specific contract terms, and the amount may be due in more than one accounting period. Answers will vary but may https://goodmenproject.com/business-ethics-2/navigating-law-firm-bookkeeping-exploring-industry-specific-insights/ include vehicles, clothing, electronics (include cell phones and computer/gaming systems, and sports equipment). They may also include money owed on these assets, most likely vehicles and perhaps cell phones. In the case of a student loan, there may be a liability with no corresponding asset (yet).

How to Calculate Net Profit Margin

For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. For example, the same T-shirt company from before also pays for warehouse space, advertisements, and small business loan payments.

- In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity.

- A business has assets of £110,000, liabilities of £30,000, income in the year of £20,000 against expenses incurred of £10,000 and capital at the beginning of the year of £70,000.

- So, every dollar of revenue an organization generates increases the overall value of the organization.

- We begin with the left side of the equation, the assets, and work toward the right side of the equation to liabilities and equity.

- Recall that equity can also be referred to as net worth—the value of the organization.