These expenses are often recorded at the end of period because they are usually calculated on a period basis. This also relates to the matching principle where the assets are used during the year and written off after they are used. Unearned revenues are also recorded because these consist of income received from customers, but no goods or services have been provided to them. In this sense, the company owes the customers a good or service and must record the liability in the current period until the goods or services are provided. Deferrals refer to revenues and expenses that have been received or paid in advance, respectively, and have been recorded, but have not yet been earned or used.

Do you own a business?

The following are the updated ledgerbalances after posting the adjusting entry. Interest Expense increases (debit) and Interest Payableincreases (credit) for $300. You will learn more about depreciation and its computation inLong-Term Assets.

Non-Cash Expenses

- This systematic allocation helps in presenting a more accurate financial position by gradually reducing the asset’s book value.

- Recall that an original source can be a formal documentsubstantiating a transaction, such as an invoice, purchase order,cancelled check, or employee time sheet.

- Other methods that non-cash expenses can be adjusted through include amortization, depletion, stock-based compensation, etc.

- Here are descriptions of each type, plus example scenarios and how to make the entries.

- This is posted to the Salaries Expense T-account on the debit side (left side).

- Interest earned by a bank is considered to be part of operating revenues.

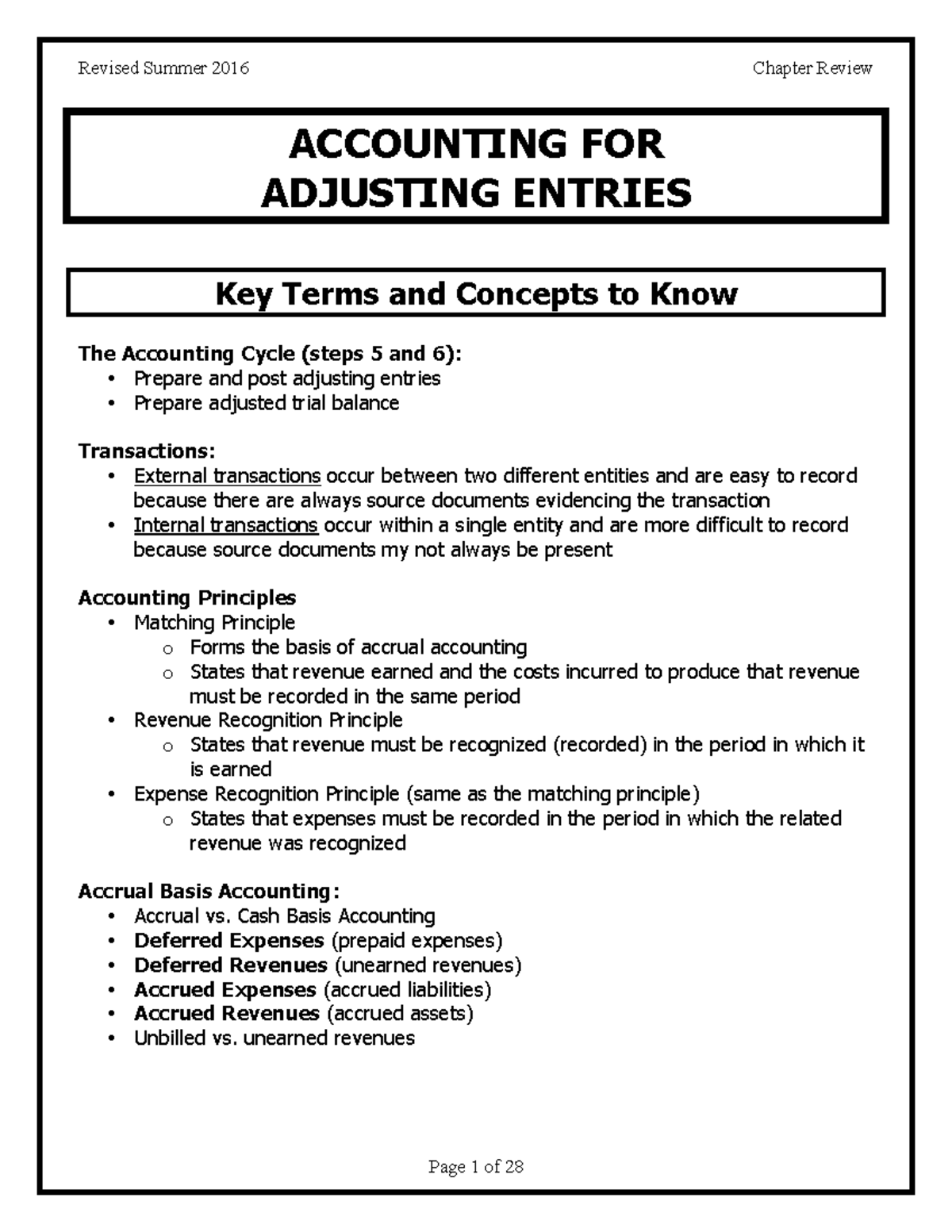

The purpose of adjustment entries is to bring the accounts up to date and to ensure that the financial statements accurately reflect the company’s financial position and performance. An adjusting entry is an entry made to assign the right amount of revenue and expenses to each accounting period. It updates previously recorded journal entries so that the financial statements at the end of the year are accurate and up-to-date. Recall from Analyzing and Recording Transactions that prepaid expenses (prepayments) are assets for whichadvanced payment has occurred, before the company can benefit fromuse. As soon as the asset has provided benefit to the company, thevalue of the asset used is transferred from the balance sheet tothe income statement as an expense. Some common examples of prepaidexpenses are supplies, depreciation, insurance, and rent.

To Ensure One Vote Per Person, Please Include the Following Info

Another situation requiring an adjusting journal entry arises when an amount has already been recorded in the company’s accounting records, but the amount is for more than the current accounting period. To illustrate let’s assume that on December 1, 2023 the company paid its insurance agent $2,400 for insurance protection during the period of December 1, 2023 through May 31, 2024. The $2,400 transaction was recorded in the accounting records on December 1, but the amount represents six months of coverage and expense. By December 31, one month of the insurance coverage and cost have been used up or expired. Hence the income statement for December should report just one month of insurance cost of $400 ($2,400 divided by 6 months) in the account Insurance Expense.

Accounting 101: Adjusting Journal Entries

You cover more detailsabout computing interest in Current Liabilities, so for now amounts are given. A current asset which indicates the cost of the insurance contract (premiums) that have been paid in advance. It represents the amount that has been paid but has not yet expired as of the balance sheet date.

Since the company has not yet provided the product orservice, it cannot recognize the customer’s payment as revenue. Atthe end of a period, the company the successful bookkeeper will review the account to see ifany of the unearned revenue has been earned. Fees earned from providing services and the amounts of merchandise sold.

As a result the company will incur the utility expense before it receives a bill and before the accounting period ends. Prepaid expenses or unearned revenues – Prepaid expenses are goods or services that have been paid for by a company but have not been consumed yet. This means the company pays for the insurance but doesn’t actually get the full benefit of the insurance contract until the end of the six-month period. This transaction is recorded as a prepayment until the expenses are incurred. Only expenses that are incurred are recorded, the rest are booked as prepaid expenses.

If the person who maintains your finances only has a basic understanding of bookkeeping, it’s possible that this person isn’t recording adjusting entries. Full-charge bookkeepers and accountants should be able to record them, though, and a CPA can definitely take care of it. This is posted to the Unearned Revenue T-account on the debit side (left side). You will notice there is already a credit balance in this account from the January 9 customer payment. The $600 debit is subtracted from the $4,000 credit to get a final balance of $3,400 (credit).

It has already been mentioned that it is essential to update and correct the accounting records to find the correct and true profit or loss of the business. Recording such transactions in the books is known as making adjustments at the end of the trading period. If making adjusting entries is beginning to sound intimidating, don’t worry—there are only five types of adjusting entries, and the differences between them are clear cut. Here are descriptions of each type, plus example scenarios and how to make the entries. If you do your own accounting, and you use the accrual system of accounting, you’ll need to make your own adjusting entries. To make an adjusting entry, you don’t literally go back and change a journal entry—there’s no eraser or delete key involved.

The primary purpose of adjusting entries is to update account balances to conform with the accrual concept of accounting. A nominal account is an account whose balance is measured from period to period. Nominal accounts include all accounts in the Income Statement, plus owner’s withdrawal.

The accounting cycle is the process of recording, classifying, and summarizing financial transactions for a given accounting period. Using the tableprovided, for each entry write down the income statement accountand balance sheet account used in the adjusting entry in theappropriate column. Recall that unearned revenue represents a customer’s advancedpayment for a product or service that has yet to be provided by thecompany.