Fixed assets are physical (or “tangible”) assets that last at least a year or longer. While straight-line depreciation is the most commonly used method, other methods such as units of production, sum of the year’s digits, and declining balance exist. If an asset will have a residual value at the end of its service life that can be realized through sale or trade-in, depreciation should be calculated https://kashlinskaya.ru/content/pub/2018/round-9-report-chess-com-isle-man-international on cost less the estimated salvage value. Remember, the depreciable life is the term the asset is used by the owner, but if the asset is not worthless at the end of that life, estimated salvage value should be considered.

- Managing fixed assets effectively means optimising asset value or return on investment (ROI) at each stage of the life cycle.

- This involves not only the initial acquisition but also any subsequent improvements, disposals, or transfers.

- A fixed asset is a long-term tangible property or equipment a company uses to operate its business.

- Types of fixed assets common to small businesses include computer hardware, cell phones, equipment, tools and vehicles.

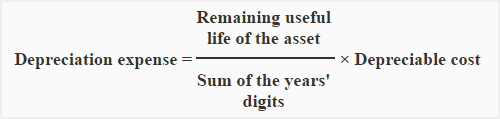

- You’ll record larger depreciation expenses during the early years of an asset’s useful life and smaller depreciation expenses later.

Asset Disposal and Impairment

- This metric is particularly important in asset-heavy industries like manufacturing, retail, and logistics, where effective use of infrastructure directly impacts profitability.

- A formula is used when calculating net fixed assets, according to My Accounting Course.

- This can enhance the company’s borrowing capacity and overall financial standing.

- Implementing robust internal controls is essential for safeguarding an organization’s fixed assets.

- The anticipated duration over which the fixed asset is expected to provide economic benefits to the company.

- For instance, a piece of real estate purchased years ago may have appreciated significantly, necessitating a revaluation to capture its current worth.

The fair market value of fixed assets is recorded at their initial cost, including all expenses incurred to acquire, prepare, and bring the asset to its intended use. Under IFRS, impairment losses can be reversed if the asset’s recoverable amount increases in subsequent periods, whereas GAAP prohibits the reversal of https://medhaavi.in/best-social-media-platforms-to-market-your-business-in-2021/ impairment losses once they have been recognized. These differences necessitate a thorough understanding of the applicable standards to ensure compliance and accurate financial reporting. Organizations operating internationally or considering a transition between frameworks must carefully evaluate the implications of these differences on their fixed asset accounting practices. Organizations may present fixed assets in a number of different ways on the balance sheet. Conversely, they could also be presented as the gross value of total fixed assets along with the accumulated depreciation recognized to date, aggregated to their net value.

Depreciation methods for fixed assets

- Non-operating assets do not directly relate to operations but still contribute to revenue generation.

- Request the invoices for these assets to confirm that they are recorded at the correct values and dates.

- If the car is used in a company’s operations to generate income, such as a delivery vehicle, it may be considered a fixed asset.

- Regular training sessions can help ensure that staff members understand and adhere to these policies.

- The ability to scrutinize financial data, identify trends, and make informed decisions is crucial.

This metric is particularly important in asset-heavy industries like manufacturing, retail, and logistics, where effective use of infrastructure directly impacts profitability. Fixed assets most commonly show on a balance sheet as property, plant and equipment (PP&E). If a fixed asset gets damaged during its lifetime, you’ll need to adjust the value to reflect the decrease in market value. When the asset is sold or disposed of, the fixed asset is written off the balance sheet. Because fixed assets are non-current assets that help your business bring in revenue over the long term, they are typically high value investments for the company. Depreciation is the systematic way to transfer fixed assets’ costs to the income statements based on the amount of assets’ contribution to a specific period or measurement compared to the total cost of assets.

Objective of asset management: Optimising asset value

This approach is beneficial for assets that quickly lose value or become obsolete, such as technology equipment. By applying a fixed percentage to the book value of the asset each year, this method reflects the rapid decline in utility and market value. For example, a computer system might depreciate at a rate of 20% per year, resulting in a higher expense initially, which gradually decreases over time.

This involves comparing the fixed asset register with the general ledger to identify and resolve https://energy-comfort.ru/1395-ramy-dlya-solnechnykh-kollektorov-sravnenie-raznykh-proizvoditelej-i-ikh-predlozhenij.html discrepancies. Regular reconciliation helps maintain the integrity of financial statements and supports effective asset management. By periodically verifying the existence and condition of fixed assets, organizations can identify discrepancies between physical assets and accounting records.